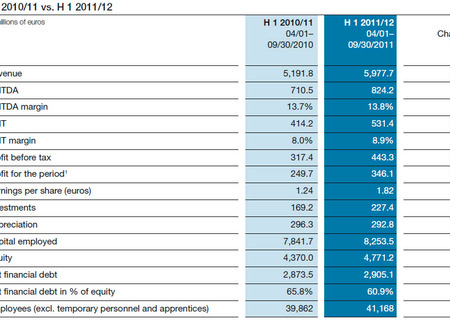

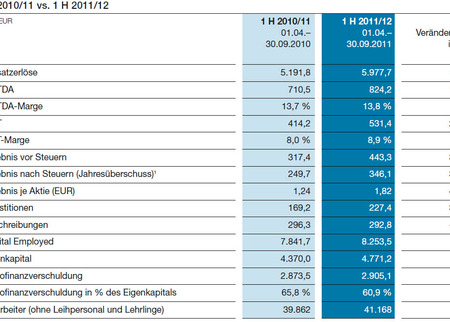

With the exception of the Steel Division (shutdown during the second quarter to complete investments), all divisions contributed to this positive trend, whereby the Special Steel Division, with its EBIT increase of 88.7% compared to last year’s figure, deserves special mention. But the other divisions also reported two-digit growth rates in EBIT. In addition to the gratifying trend in operating results, profit before tax and profit for the period have gone up substantially compared to the previous year’s figures. EBT rose from EUR 317.4 million to EUR 443.3 million or 39.7%, while the profit for the period went from EUR 249.7 million to EUR 346.1 million, an increase of 38.6%. For the first half of this business year, earnings per share (EPS) were EUR 1.82 per share (previous year: EUR 1.24).

Equity rose in the first six months of the business year 2011/12 (March 31, 2011) by EUR 80.1 million or 1.7% to EUR 4,771.2 million. The increase is due to the very positive profit for the period, whereby the payment of a dividend in the amount of EUR 135.0 million in the second quarter of the business year as well as the proportionate share of reserves for interest on hybrid capital of EUR 65.2 million had the customary subduing effect on the trend in equity. The most significant factors for the build-up of working capital and the resulting increase of net financial debt by 7.1% from EUR 2,713.1 million as of March 31, 2011 to EUR 2,905.1 million as of September 30, 2011 were rooted in the seasonal effects and the economy in general, but also in operational effects resulting from the three-week shutdown in the Steel Division. Against this background, as of the end of the first half year 2011/12, there was a gearing ratio (net financial debt as a percentage of equity) of 60.9%. Thus, it is 3.1 percentage points above the figure as of March 31, 2011 (57.8%), however, it will decrease substantially in the course of the year.